Gift City Funds (GCF)

In the heart of Gujarat, India, lies a groundbreaking financial hub GIFT City, India's first International Financial Services Centre (IFSC). Designed to attract global investments, it offers a world-class infrastructure and a regulatory framework specifically tailored for international financial transactions. A cornerstone of this ecosystem are Gift City Funds, a unique and lucrative investment opportunity for those seeking exposure to global markets.

Gateway to Global Investing Through GIFT City

At AltPortFunds, we help investors access international investment opportunities seamlessly through GIFT City (Gujarat International Finance Tec-City), India’s international financial hub.

We curate regulated global funds, alternative strategies and multi-currency products that combine global access with Indian efficiency.

WHY INVEST THROUGH GIFT CITY WITH ALTPORTFUNDS?

Access. Regulation. Opportunity GIFT City offers Indian investors a unique platform to invest globally while staying within India’s financial ecosystem.At AltPortFunds, we simplify access by evaluating credible fund houses, strategies and structures available under the IFSC (International Financial Services Centre) framework.

What Sets Us Apart:

Access to SEBI-registered global and domestic fund managers operating from GIFT City

Investment options across global equities, debt, alternatives and multi-asset funds

Regulatory clarity with tax-efficient structures under India’s IFSC regime

Independent research and strategy evaluation before recommendation

End-to-end support, from onboarding to compliance documentation

Experience global investing through a secure, transparent and institutionally curated gateway, with AltPortFunds as your trusted guide.

WHAT ARE GIFT CITY FUNDS?

GIFT City Funds are India-domiciled offshore investment vehicles that allow investors to participate in international markets under a regulated, tax-efficient structure.

These funds bridge the gap between India and the world, combining global exposure with Indian compliance advantages.

Global Equity Funds

Participate in U.S., Europe and Asia-Pacific markets through regulated IFSC structures.

Debt & Fixed Income Funds

Access high-grade international bonds and income-focused strategies.

Alternative & Thematic Funds

Invest in niche strategies such as technology, renewable energy or healthcare themes.

Multi-Currency Funds

Diversify exposure across USD, EUR, GBP and other leading currencies.

With GIFT City, you can invest globally without moving capital overseas — seamlessly, transparently, and efficiently.

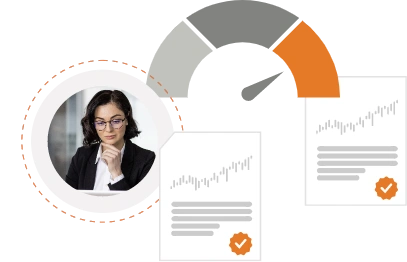

OUR ADVISORY APPROACH

At AltPortFunds, we go beyond access, we ensure that every GIFT City investment aligns with your global diversification goals and risk appetite.

Our approach focuses on clarity, comparison and compliance.

Research-Based Selection

Evaluation of fund structure, performance and underlying exposures.

Tax & Regulatory Clarity

Guidance on IFSC’s tax advantages and LRS implications.

Portfolio Integration

Aligning global exposures with your existing Indian portfolio.

Ongoing Oversight

Continuous tracking and communication on fund updates, currency moves and market shifts.

We make global investing not just accessible, but intelligible, combining local expertise with international insight.

THE ADVANTAGE OF GIFT CITY INVESTING

GIFT City represents the convergence of India’s financial intelligence and global opportunity. It provides a regulated environment under SEBI and IFSCA, designed for transparent, tax-efficient global investing.

With AltPortFunds, investors can leverage:

Zero capital gains tax on certain categories of funds

Reduced compliance vs direct overseas investing

Exposure to global markets through familiar Indian intermediaries

Professional advisory and structured onboarding support

Global investing through GIFT City — simplified, compliant, and curated for Indian investors who think beyond borders.

Who Should Opt for Gift City Funds

High-Risk Appetite

Aligned Investment Goals

Global Investment Outlook

Larger Capital Base

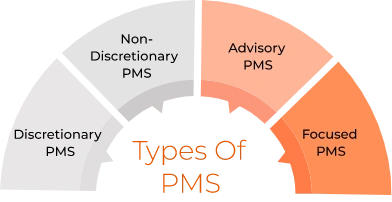

Categories of Gift City Funds

Alternative Investment Funds

Portfolio Management Services (PMS)

Advantages Of Gift City Fund

01

Globally Diversified Portfolio

Don't settle for limited options. Access a diverse pool of expert portfolio managers, ensuring your investment strategy is always optimized.

02

Potential Tax Savings

Explore the tax benefits offered by specific funds (consult a tax advisor for details).

03

Foreign Currency Investment

Invest and redeem in foreign currencies like USD or EUR.

04

Secure and Transparent Environment

Benefit from a well-regulated investment environment overseen by IFSCA.

05

Professional Fund Management

Experienced fund managers handle investment decisions, allowing you to focus on your overall financial strategy.

Top Gift City Fund Products

Your Goals, Our Curated Funds

As the best PMS AIF Service Provider in India, we streamline the process by carefully selecting top-performing funds that align with your investment objectives. Our proficient team diligently analyzes thousands of options to curate a portfolio of exceptional products, saving you time and effort.

- Gift City Fund

Uncover Your Investment Potential with Process-Driven Insights

Our platform is designed to match you with the right Gift City AIF and PMS products based on a comprehensive understanding of your risk tolerance, investment horizon, and financial goals. By completing our risk profiler, you'll enable us to recommend investment strategies that align with your objectives. Start your journey towards informed investment decisions and explore the strategies best suited to your financial aspirations.e got you covered.

GCF Frequently Asked Questions

Unsure about PMS and AIF? Our FAQ section covers the most common questions investors like you have.

-

What are GIFT City Funds?

AIFs: Gift City AIFs provide greater flexibility in investment strategies compared to mutual funds, allowing them to invest in private equity, real estate, hedge funds, start-ups, and other alternative assets that can potentially generate significant returns.

PMS: PMS provides a dedicated portfolio manager who tailors a portfolio specifically for you. They actively manage your investments across various asset classes, including equities and fixed-income.

-

Why GIFT City?

Lower Operating costs

Competitve Tax Regime

Enagement with Unified financial regulator

Enabling ecosystem for fund management

No diversification limits on investments made by AIF in IFSC -

Why Consider Gift City Funds?

Several compelling factors make Gift City AIF attractive for international investors:

Global Diversification: Access a wider range of international assets to boost growth and reduce risk.

Tax Benefits: Potential tax advantages for certain funds.

Foreign Currency Investments: Invest in currencies like USD or EUR, hedging against currency risks.

Strong Regulation: IFSCA ensures investor protection with a transparent framework.

Easy Access: Simplified investment process via authorized intermediaries. -

Who Can Benefit from GCF?

Investors with the following characteristics are well-suited for Gift City Funds:

High-Risk Appetite:Suitable for those comfortable with higher risks.

Aligned Investment Goals: Ideal if the fund’s strategy matches your financial objectives.

Global Investment Outlook: Perfect for those looking to invest internationally.

Larger Capital Base: Some funds require significant minimum investments.

Other Investment Avenues

- PMS

- AIF

- Other Products

Portfolio Management Services

Is an investment portfolio in equities, fixed income, debt, cash, structured products, and other individual assets that is managed by a professional money manager and may be adjusted to fit specific investment objectives.

Alternative Investment Funds

AIF operates as an exclusive club, offering unique experiences not available to the general public. In the financial context, AIFs diverge from traditional investment regulations, presenting investors with unconventional and exclusive investment opportunities. It's like being part of an exclusive club that introduces you to investments beyond the ordinary.

Invest Now

By submitting the form you authorize ALTPORT to call or email you.

Wisdom Hub

Wisdom Hub is Your Go-to Resource

Our PMS & AIF Portal believes in the power of knowledge. That's why we offer many resources blogs, videos, and podcasts to help you make informed investment decisions. Whether you invest with us or another advisor, our goal is to equip you with the insights you need to succeed.

BLOGS

Book A Meeting

Book A Meeting